how do i get my employer to withhold more tax

The Withholding Form. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

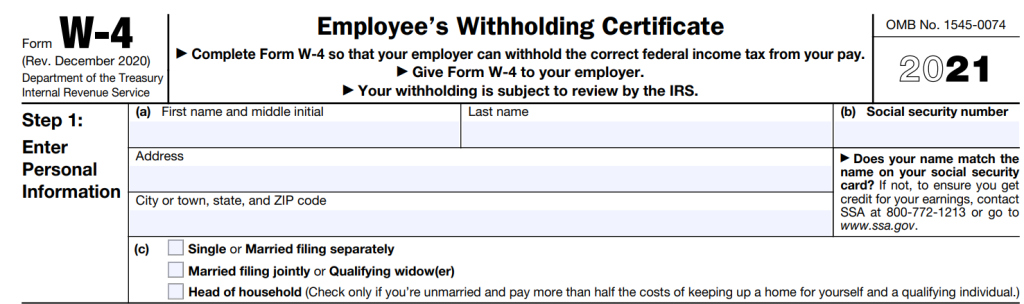

W 4 Form How To Fill It Out In 2022

To do this they have to give a federal Form TD1.

. An employers filing frequency for state income tax withholding is determined each calendar year by the combined amount of state and school district taxes that were withheld or required to be. Total state tax before the Resident Credit 4800. Details of the additional amounts to withhold are included in the tax tables.

Schedule 1 - Statement of formulas for calculating amounts to be withheld. This includes tax withheld from. You can use the IRS Withholding Estimator to determine the best way to fill out your W4 to resolve the issue this year and then you can run it again at the start of next year to choose the.

Enter your personal information. A Form W-4 is really straightforward. If you earn 50000 before taxes and you contribute 2000 of it to your 401 thats 2000 less youll be taxed on.

The first step is filling out your name address and Social Security number. But the IRS introduced a new Form. You need to submit a new W-4 to your employer giving the new amounts to be.

If your withholding liability is 1000 or more your withholding. Use the IRS Withholding Estimator to estimate your income tax and compare it. New Jersey tax before we factor in the Resident Credit 90000 x 4 3600.

The information you give your employer on Form W4. If your withholding liability is more than 100 but less than 1000 your withholding returns and tax payments are due monthly. To change your tax withholding use the results from the Withholding Estimator to determine if you should.

When you file your tax return. For more information visit. The changes to the tax law could affect your withholding.

Quarterly If total withholding is under 300 per quarter the taxes. Complete a new Form W-4 Employees. On the New employment screen completing your Withholding declaration remembering that when we say employer we mean your payer even if they are not an employer.

An example of how this works. The amount of income tax your employer withholds from your regular pay depends on two things. Increasing income tax deductions.

To make sure your withholding is more accurate next year you can fill out an updated Form W-4 and send it to your employer. An employers filing frequency for state income tax withholding is determined each calendar year by the combined amount of state and school district taxes that were withheld or required to be. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer.

If you have no employer to withhold federal taxes then youre responsible for withholding your own. Determine if estimated tax payments are. New York tax 80000 x 6 4800.

Employers currently withhold and remit employees taxes on wage and salary income according to the following schedule. The amount you earn. How can I get less withheld from my paycheck.

Multiple jobs or spouse works. Change Your Withholding. You can get a.

Your employer is obligated to transfer. According to federal tax law all salaried workers and wage earners must pay the payroll tax at the rate of 42 percent of their gross earnings in 2012. All youll need is.

How to Check Your Withholding. Employees can choose to have more tax deducted from the remuneration they receive in a year. To adjust your withholding is a pretty simple process.

What Is Federal Tax Withholding Ramsey

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

/GettyImages-1022726684-c6aca920e9064557add6198059c1f2d2.jpg)

Form W 4 What It Is Who Needs To File And How To Fill It Out

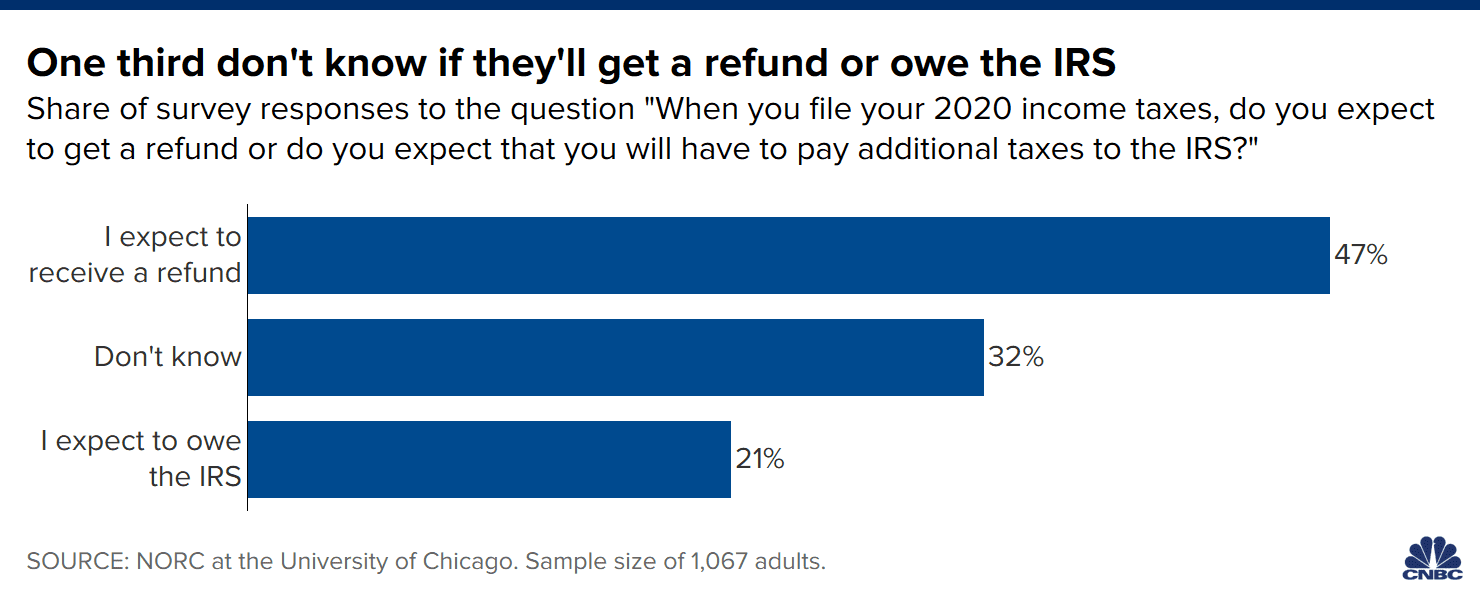

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Client Question What Should I Do If An Employee Claims A High Number Of Exemptions Shindelrock

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

How Many Tax Allowances Should I Claim Community Tax

Payroll Tax What It Is How To Calculate It Bench Accounting

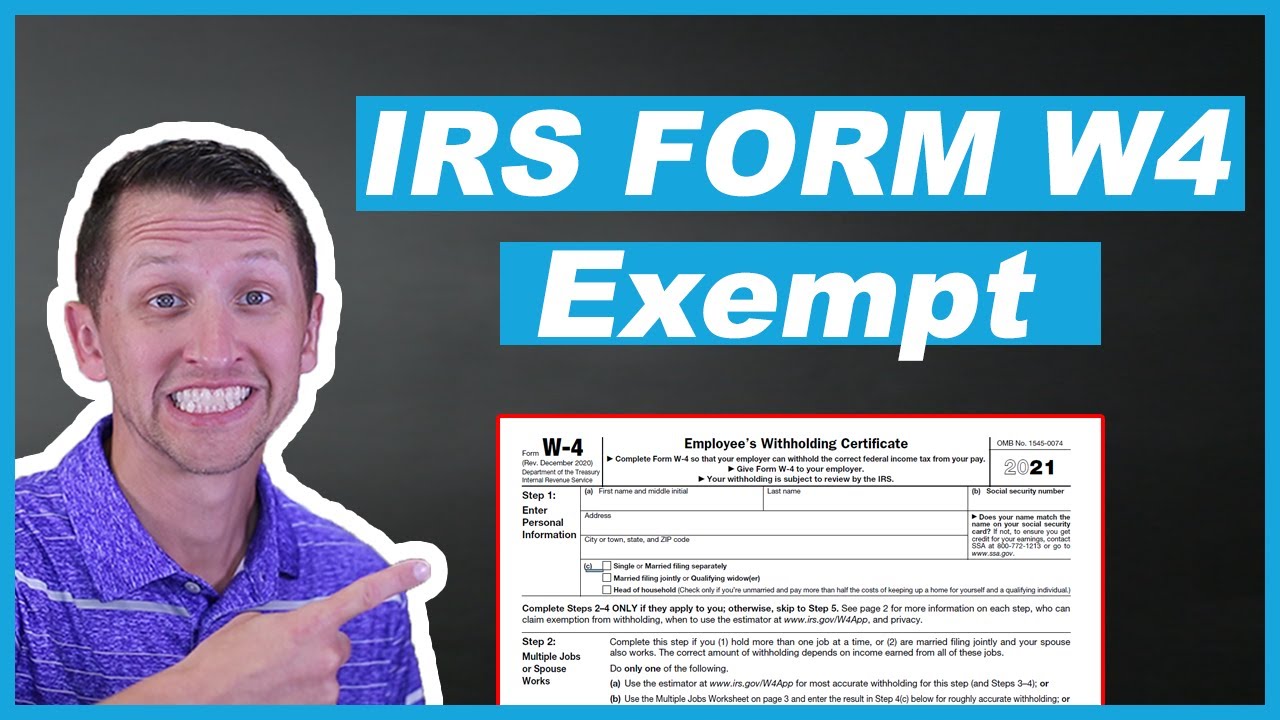

How To Fill Out Irs Form W 4 Exempt Youtube

Understanding Your W 4 Mission Money

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Tax Withholding For Pensions And Social Security Sensible Money

State Withholding Form H R Block

Everything You Need To Know About The New W 4 Tax Form Abc News